U.S. Treasury turns entitlements into infrastructure

We heard from the head of the US Treasury last week that the US economy is in great shape. Janet Yellen, Secretary of the Treasury, is an esteemed professional economist. But her speech for the Davos Agenda on January 21, 2022 represents the full politicization of the Treasury and leaves us no more informed about our economic status than general journalism. The Treasury creates a false economic premise, which is that entitlements are the infrastructure of our future economic system.

Here are three points and some comments of mine to consider about the speech:

1. The Secretary said that the economic recovery from the Covid recession was shorter than what professional economists envisioned at the time Covid hit. She also said that the recovery was the result of the American Rescue Plan as well as rapid vaccine development. The current inflation data though shows that the Plan far overdid the amount of money needed. It added a huge stimulus to the already soaring demand in the economy.

2. The Secretary uses estimates from the private sector to predict future economic growth. She cites the Blue Chip forecast for 2022 growth of 3.3 percent. Private sector economists would disagree with the Blue Chip assessment. There are economists predicting a recession.

3. The Secretary also references easing congestion in ports as a means of reducing inflation. Of course, controlling inflation is the key to our future economic growth and the critical item for the Treasury to get right.

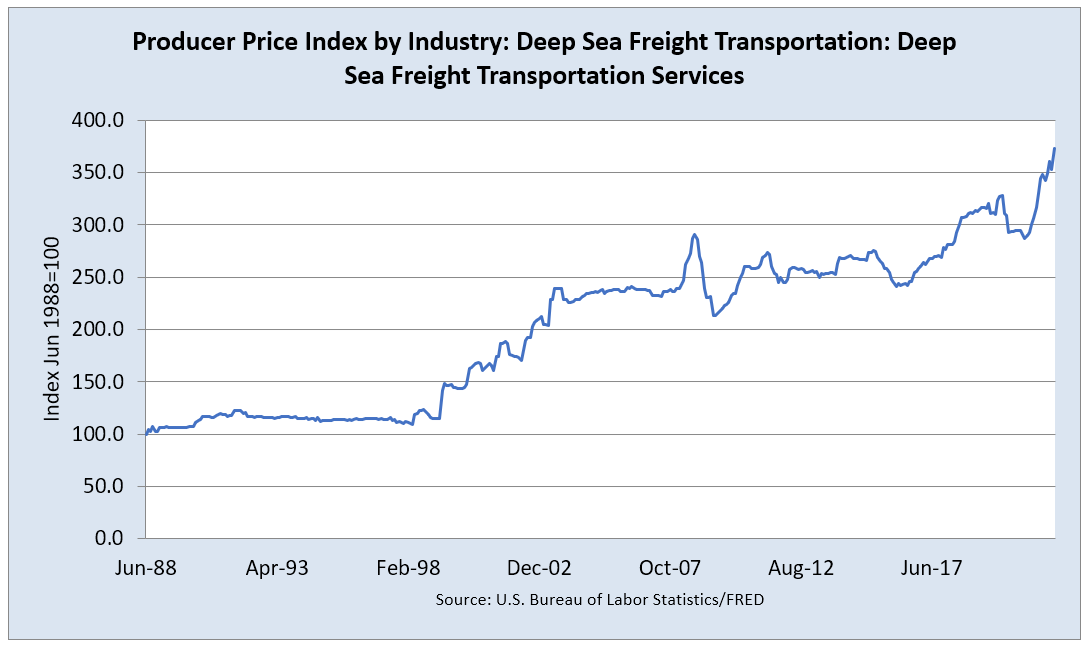

Graph one shows the international freight costs from 1/1/88 to 12/1/21. If supply chain relief is to reduce inflation as the speech says, there is little evidence of that in the chart. This is at odds with the Blue Chip forecast which the Treasury is relying on. Problems with the supply chain, according to the speech, will not affect economic growth. The chart shows that the Sea Freight Transportation Services index is up and away, making it unlikely that supply chain problems are being resolved.

Graph 1

If we are to believe the Secretary’s position, that leaves it to the Fed to reduce inflation with its traditional monetary tools. The Secretary’s speech leaves out any specific predictions about inflation saying only that “professional forecasters think that inflation will substantially abate next year.” [1]

Away from the Treasury presentation, professional economists have not been shy of forecasts. Unfortunately, these predictions have displayed an inability to predict inflation. Here are two recent economic estimates.

A World Bank study applied economic models to predict 2021 inflation and found that “model-based forecasts and current inflation expectations point to an increase in inflation for 2021 of just over 1 percentage point.” [2] In fact, in 2020, inflation was 1.23% In 2021, the year that was predicted, inflation was 6.8%.

In May of 2021, we received more private sector estimates. A Yale study predicted that for 2022, “the inflation rate is forecast to rise to slightly under 5 percent by the middle of 2022 and then comes down slowly.” [3] With inflation currently 7%, we can safely disregard this estimate even if the Treasury does not.

If you do not have a model, make one up

Economic models have had a tough couple of decades. The Great Recession demolished the Efficient Market’s Hypothesis even if prior market moves had not eradicated it before. Who could say that prices reflected any level of informational accuracy during the meltdown of that era?

For inflationary predictions, the Phillips Curve was the core model. It has probably never been a decent predictor of the relation between unemployment and inflation. But economists are reluctant to give up on it. Still, the Phillips Curve is dead as a reliable tool.

To fill an ever-increasing void of economic tools, “modern” renditions of old models have been revived, if they met the goal of increasing central government authority. Modern Monetary Theory (MMT), which is not modern at all, teaches that for a country like the US, government borrowing does not matter. Federal deficits, under the theory, were just an accounting figure unless the borrowing created inflation. Washington has widely adopted MMT even as deficits have soared and inflation moves into high gear.

Now, we have the US Treasury proposing Modern Supply-Side Economics (MSSE) which converts entitlement programs into economic development programs. It merely says that the beneficiaries of the broad social programs of the Biden Administration are producers rather than consumers in our society. Calling the product of these social programs a supply function does not make them so.

We hope you enjoyed this article. Please give us your feedback.

This article is not intended as investment, tax, or financial advice. Contact a licensed professional for advice concerning any specific situation.

[2] Ibid.

[3] Fair, R.C. What do price equations say about future inflation?. Bus Econ 56, 118–128 (2021). https://doi.org/10.1057/s11369-021-00227-2