Can California kill the Golden Goose?

Among the tax fights in Washington, none has been more heated than the State and Local Tax (SALT) deduction. But that discussion is a red herring. The real issue is not the deductibility of state taxes but the level of state taxes in the first place. By allowing people to deduct state taxes from income, the Federal government lowers federal taxes and reduces the effective state tax rate. State taxpayers would be better off having lower state taxes to begin with.

The loss of the SALT deduction hurts the fiscal position of the state, particularly California and other high tax states. Those states have spent the last several years creating workarounds to allow the deduction for certain types of businesses. But the pressure for higher taxes in California is relentless. California Democrats are proposing funding a universal health care program. It envisions an increase of 2.3% in company payroll tax, and a 2.5% surtax for high earners. These taxes come on top of a top individual rate of 13.3%.

This almost complete insensitivity to the consequences of tax rates in California provides a natural experiment in tax policy. Evidence is mounting that people move themselves or their money when taxes in a state increase. The most interesting question and the most serious threat to a state like California, however, is whether high state taxes put the state’s innovation engine, its Golden Goose, in jeopardy by encouraging resident inventors to move and discouraging other inventors from moving there. The loss of SALT and increase in taxes over the years has begun the process of moving individuals and invention out of the state. The new tax proposals could be California’s tax tipping point for innovation and kill the Golden Goose.

Tax mobility is key

The SALT deduction has been declining in importance for years. Restricting SALT effectively increases state income tax rates nationally by eliminating the ability to use the state taxes to reduce Federal tax liabilities. In 2017, the Congress reduced SALT to a maximum of $10,000 per year. States became concerned about tax flight from the restrictions on SALT and began a movement to create workarounds. These workarounds retained the benefits of the full SALT deduction for some pass-through businesses following IRS rules. Congressional representatives from several high tax states are now appealing to the Supreme Court to reinstate the deduction.

The importance of that case pales, however, with the introduction of new legislation in California to double state income taxes. The anticipation of such a tax increase, let alone its actual passage, will allow economists to assess the Tax Flight hypothesis. But, even more serious, it will show whether or not California can kill its innovation Golden Goose by driving inventors out.

California can do no wrong – fiscally at least

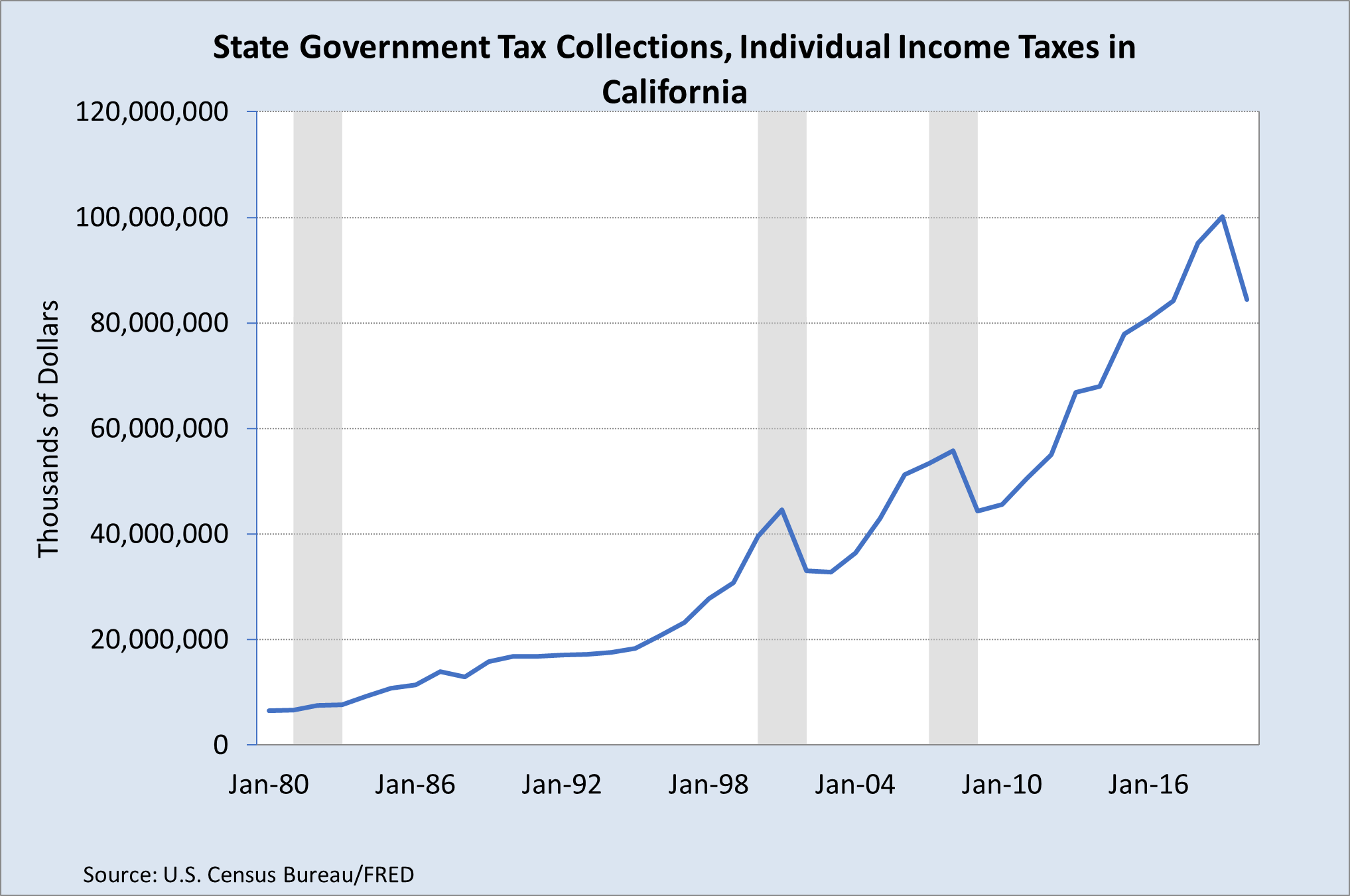

High income individuals have carried taxes in California for years. The top 1% of income taxpayers now pay around half of all state income taxes. California has sustained this top-heavy progressive tax system with state individual income tax revenues, which seem ever increasing. Graph 1 shows the relentless rise of California’s prosperity and individual income taxes collected by year. Population growth and the tech revolution have propelled individual income tax from the 1980s. The Graph ends with the 2019 revenues before the receipt of Federal aid and the recovery of the economy.

Graph 1

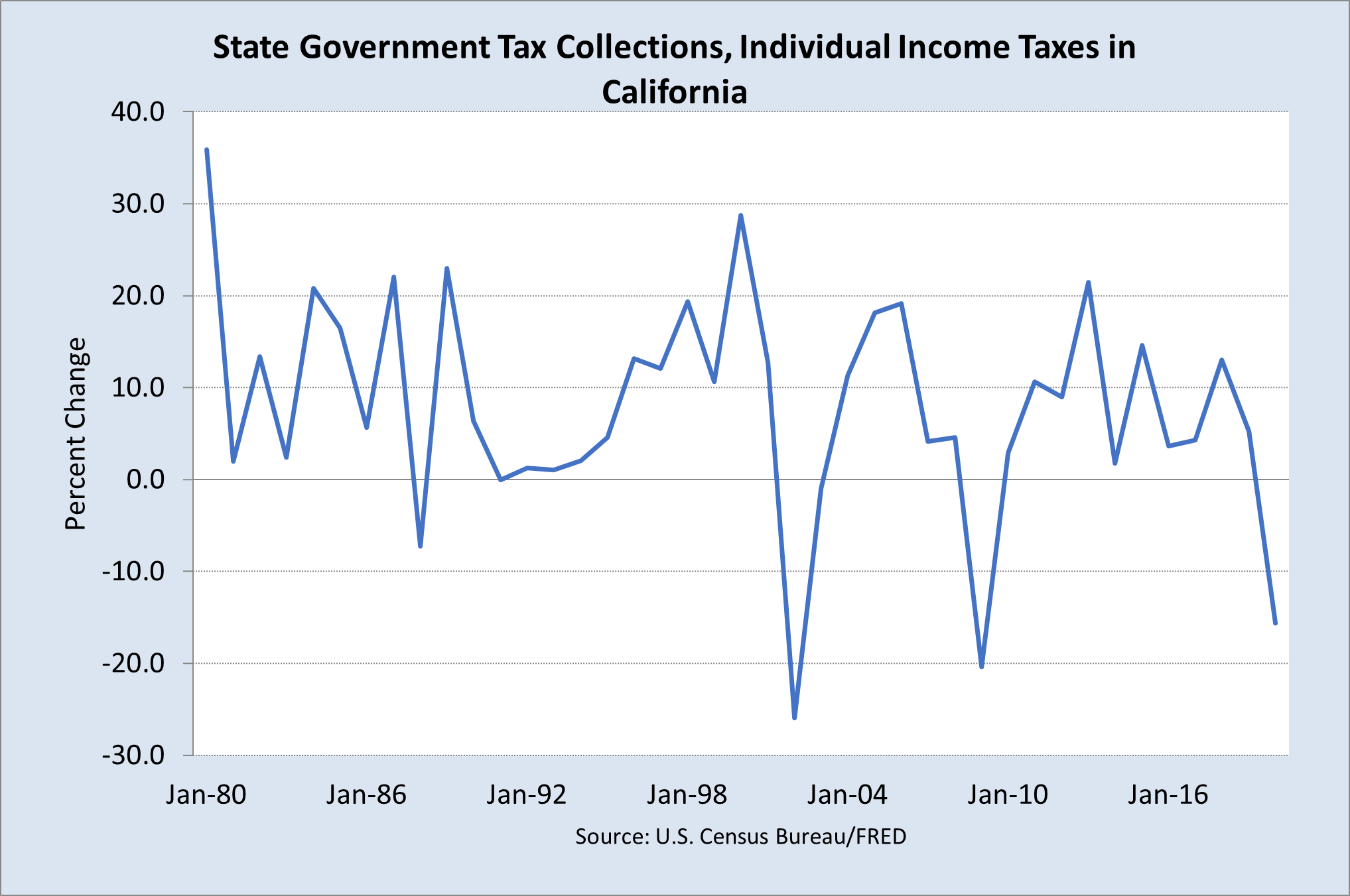

Graph 2

The only problem with the concentration of income taxes on the high-income individuals comes with recessions. Graph 2 shows the extreme volatility of the state’s revenues. The amplitude of the series featuring a range from about +30% to -20% is a prescription for crisis in public finance. Rainy day funds can help smooth out the budget effects, but the fiscal crisis of 2009 showed how quickly the state got into dire circumstances when high incomes fell.

If individuals move, will Silicon Valley?

One of the anomalies of this discussion of taxes and state budgets is that a wide range of economists for years have argued that an increase in taxes does not motivate high income individuals to move. If you believe this argument, high income individuals are beyond “mathematical automatons, or more simply, are economic zombies. Early work from state economists alleged that most people do not move in any given year. The argument is that the rich can afford more than average people and so they will not move even if taxes rise.

While there is still an active dialogue on the topic, the data shows that, like all people, high income individuals are slow to move. But they move their money very quickly. One study is particularly telling. California raised the top marginal rate by three percent for top earners in 2012. The number of out of state moves from high income individuals rose the next year. Those who stayed reduced their income. Overall, the state lost 45% of the tax increase the first year and 61% in two years.

Of even more concern is the work done studying individual inventors.

“We find that superstar top 1% inventors are significantly affected by top tax rates when deciding where to locate.” [1]

The most productive inventors watch tax rates closely in choosing where to locate. High taxes reduce the amount and quality of the innovators. Indeed, I wonder whether all those brilliant inventors would have created Silicon Valley today given its current tax environment. And more importantly, I wonder how long the Golden Goose can survive. Yes, California can kill the Golden Goose.

[1] “Taxation and the International Mobility of Inventors” PIER Working Paper 15-014, Penn Institute for Economic Research, February 16, 2015.

We hope you enjoyed this article. Please give us your feedback.

This article is not intended as investment, tax, or financial advice. Contact a licensed professional for advice concerning any specific situation.